/hero card

Elevate claims processing with

drone-powered property data

Speed claims processing, conduct safer inspections, and lower costs

with EagleView Assess™ drone technology.

Carriers can now add property repair estimates

The addition of property estimates to the EagleView AssessTM offering helps carriers streamline claims processing and reduce operational costs.

Automate claims handling with the gold-standard in drone property data

EagleView’s industry-leading drone technology, EagleView Assess, enables you to conduct safer, more efficient, and lower-cost roof inspections for insurance claims. Capture high-resolution images of the entire roof, leverage AI to automatically detect damage, and create a complete digital roof reproduction – all with an easy-to-fly, autonomous drone.

Assess roof damage with confidence

See even the most subtle damage with the highest quality drone imagery on the market.

The future of roof inspections for Insurance –

now taking off!

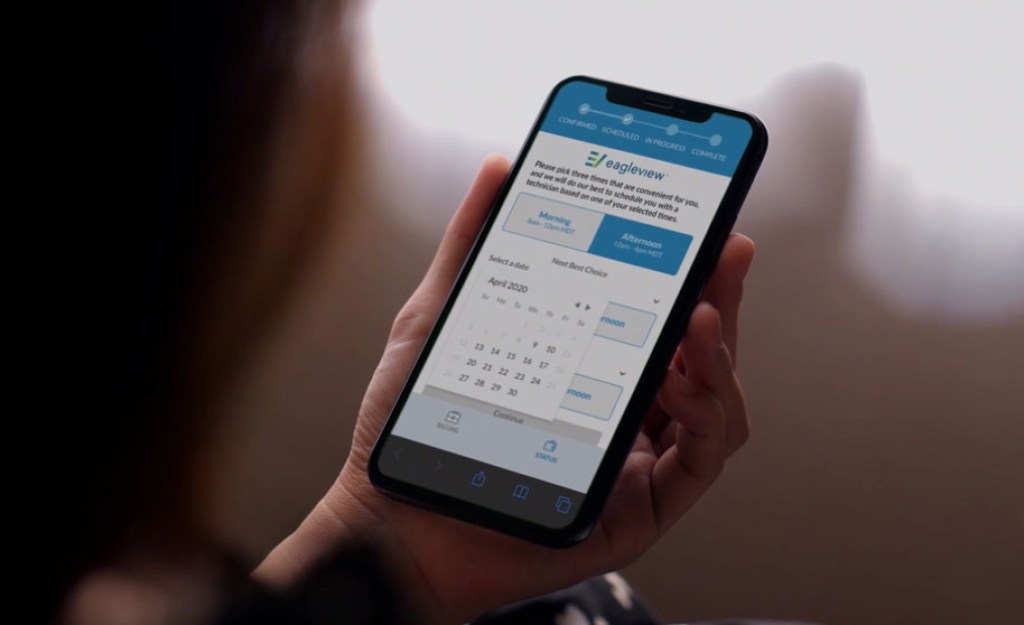

Transparent and efficient customer communication

Assess comes with a mobile interface that empowers policyholders to quickly and easily schedule inspections and receive status notifications throughout the inspection process. Plus, generate a detailed ClaimsReady Report to help policyholders better understand claims decisions.

Autonomous flight at its best

Assess drones are specifically designed for anyone to operate, consistently capturing images at a uniform height of approximately 4 feet across all roof facets and featuring advanced AI-driven obstacle detection. Take flight with a simple click, set the house boundaries, and let the drone fly itself.

AI-powered property data

Capture ultra high-resolution images and combine them to create a complete digital roof reproduction for review. Then, leverage AI to consistently and accurately identify hail, wind, and other types of damage. Eliminate the need for secondary inspections, and ‘go-to-the-roof’ from a computer.

Faster, cheaper, safer claims processing

With Assess, insurance carriers can resolve up to 1.5x more claims a day and reduce Loss Adjusted Expense by 20%, while providing more consistent claim outcomes. Leverage repeatable, consistent workflows to make fair, defensible claims decisions that can be shared with policyholders, agents, and brokers.

Get in touch to learn more about Assess

See how Mike Holmes Inspections

leverages Assess for roof inspections for

insurance claims

Mike Holmes Inspections, a firm built by Mike Holmes – contractor, creator and TV host of the one of the leading home improvement shows in North America – uses Assess to help improve the quality and efficiency of roof inspections for property insurance claims.

Drone-powered property data, designed for Insurance

Modernize your claims workflows with a comprehensive virtual inspection solution that enables more consistency, cost-savings, and enhanced customer experiences. Key features include:

Carrier scheduling portal

Self-scheduling and real-time status updates

Autonomous drone inspection

Machine learning damage detection software

Summary roof report with adjuster-selected images and annotations

Roof measurements and 3D models for estimates

Select the service that suits your needs

We offer multiple service options to choose from to better serve your unique needs.

Managed Service:

Let EagleView’s network of Assess pilots manage the inspection process for you. Policyholders can directly schedule a visit using the Assess self-scheduling tool. Our licensed pilots will visit the property, conduct the drone-based inspection, and deliver all of the imagery and analytics to you remotely.

Self Service:

Take the inspection process into your own hands. We’ll send you the comprehensive Assess solution, including an industry-leading drone, fully integrated software, and an adjuster workflow. You supply the pilots.

Resources & Insights

Why Drone-Based Technology Is the Future of Claims Adjusting

/hero card Elevate claims processing with drone-powered property data Speed claims processing, conduct safer inspections, and lower costs with EagleView Assess™ drone technology. Book a […]

Read More

Drone Roof Inspections: Why to Use Them and How to Get Started

Is your insurance company thinking about making the switch to drone roof inspections? It’s a savvy move. But you might be worried that: Fortunately, drone-based […]

Read More

How Insurance Companies Can Take On ‘The Great Retirement’ with Automation Technology

By David Bairstow, SVP & GM, Insurance By 2036, 50% of the current insurance workforce will retire, according to the United States Bureau of Labor […]

Read More

EagleView’s Property Reports: The Most Accurate Measurements on the Market

For insurance carriers, adjusters, and underwriters, accuracy is key. Accurate property data, measurements, and material breakouts are the foundation for defensible property repair estimates and […]

Read More

Drone-Based Inspections—The New Standard for Residential Insurance Claims

By David Bairstow – Senior Vice President & General Manager, Insurance Insurers of all sizes are finding themselves at a critical inflection point between the […]

Read MoreTake flight with EagleView Assess

Get in touch to book a demo and discover how Assess can help modernize your insurance claims workflows.