As consumers become more tech-savvy and have access to more channels, they are demanding insurers provide fast and accurate quotes. Property underwriters are responding by optimizing their operations while maintaining accurate risk assessments. When they can’t physically visit a property, they are turning to imagery-based solutions.

However, not all imagery solutions are created equally. Resolution from satellite imagery is too low to show property condition and only shows a home or business from the top down. Additionally, street-view imagery can’t display hazards like pools, trampolines, or debris in the backyard.

As such, many underwriters rely on the policyholder for information about the property. Oftentimes, even the property owner doesn’t recognize the risks that may be present.

Underwriters need physically verifiable imagery to have a complete picture of a property. Without a clear

360-degree view of a home, insurance carriers may not provide the correct level of coverage for a prospective policyholder or an existing one at the time of renewal.

Virtual Inspection for Underwriters

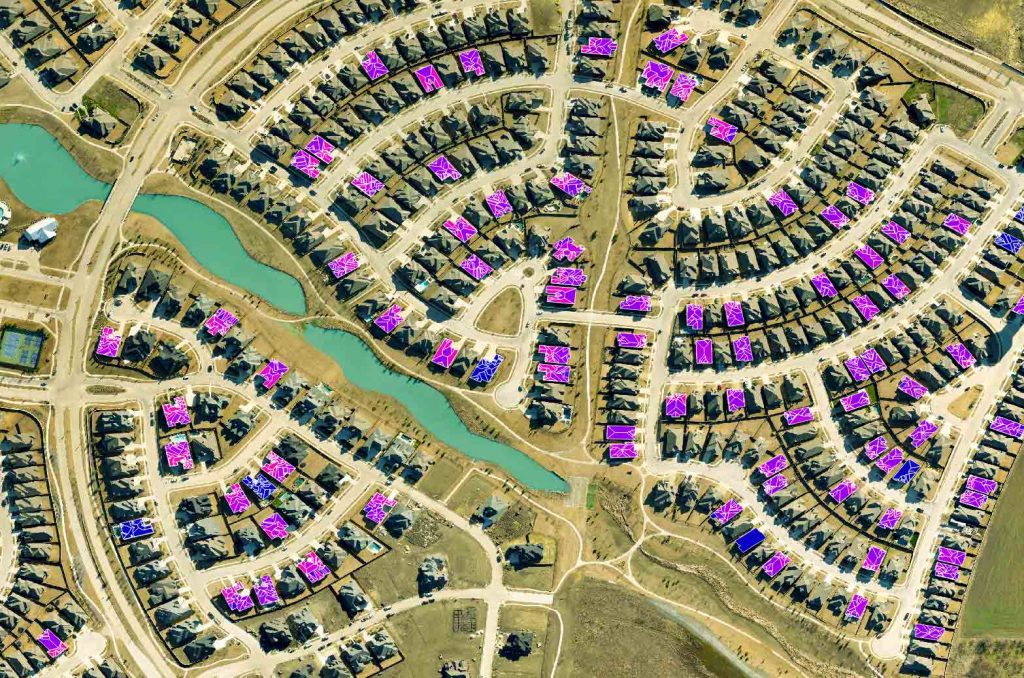

EagleView has long provided insurance carriers and other industries with high-resolution aerial imagery. But imagery is just the first step for insurance carriers.

Data derived from aerial imagery is necessary to make accurate risk assessments. EagleView can extract valuable data from imagery via

machine learning technologies. These technologies provide underwriters with the data they need more accurately than a physical inspection—and at thousands of times faster.

The new

EagleView Underwriting Virtual Inspection Service combines ultra-high-resolution aerial imagery with physically verifiable property data extracted through machine learning algorithms.

Key Data Points

Machine learning currently extracts six key property data points from ultra-high-resolution imagery, all without a site visit. These include:

- Roof Condition: General overall repair of the roof

- Roof Material: Predominant material on the outermost layer of the roof

- Roof Type: Shape of the roof

- Tree Overhang: Presence and extent of a tree canopy projecting over the structure

- Solar: Presence or absence of solar panels

- Pool: Presence or absence of a pool

Carriers can integrate the imagery and data directly into their agent, underwriting, and decision-making platforms to get answers instantly at time of quote or at time of renewal. The aerial imagery and property data are updated annually.

Benefits for Underwriters

EagleView Underwriting Virtual Inspection gives

insurance underwriters:

- Decreased processing time by up to 60 days

- Improved agent and policyholder satisfaction

- Elimination of price changes

- More profitable business closed and won

Property imagery and data aren’t just “nice-to-haves” for insurance carriers. Insurtech for virtual inspection plays an integral role in delivering better answers, more certainty, and improved satisfaction for agents and policyholders alike.

Contact us today to learn more about the

EagleView Underwriting Virtual Inspection Service.