Customer Success: Validating Roof Repair Claims with Drone Roof Inspections

The insurance claims process is a common culprit of delayed roof jobs. Roofing contractors can do everything in their power to expedite roof repair coverage approval, but if they have to rely on the insurance company’s manual inspection process, their hands are tied.

The claims process is also a reason roofers may lose jobs altogether. There’s little to be done if the human adjuster denies the claim, and the homeowner can’t pay for the repair themselves — even if the adjuster missed damage in their inspection. This dependence on the human eye to validate damage and approve roof repair claims is a huge obstacle to completing roof jobs, particularly in post-storm regions.

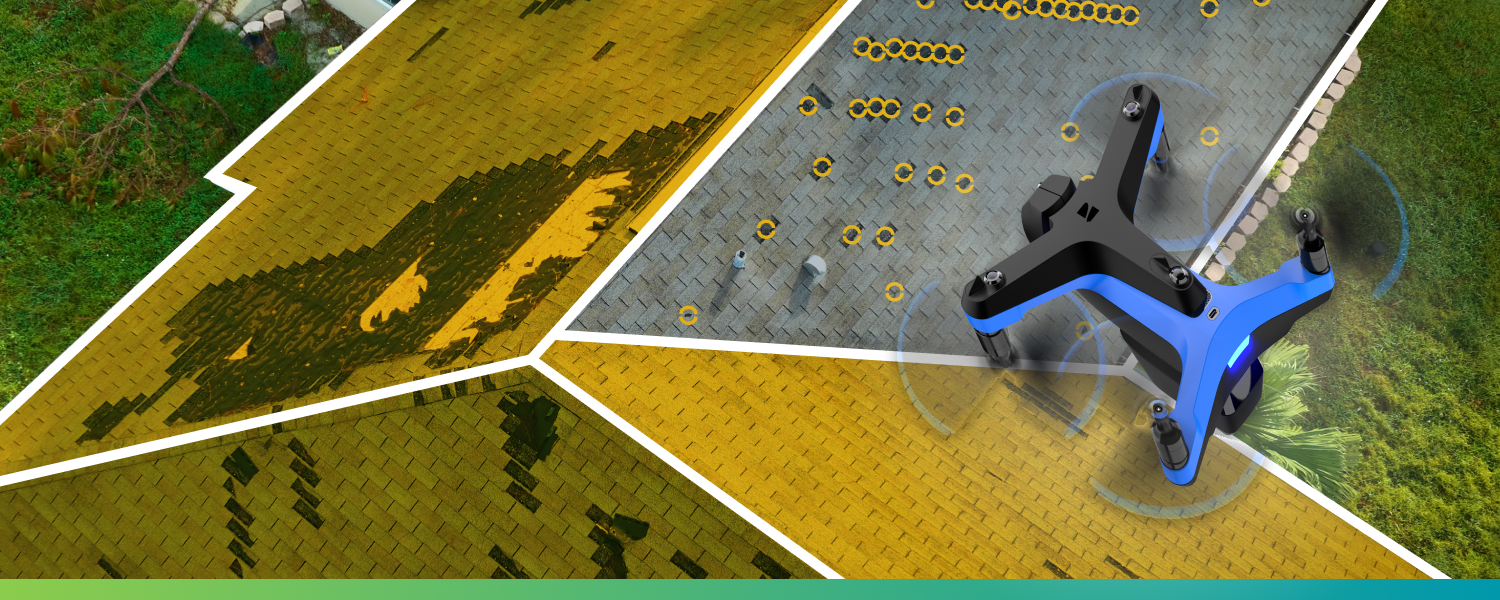

That’s why roofing contractors are turning to EagleView Assess™, the gold standard in drone-powered property data. Cornerstone Restoration and JM Home Repair is one of many customers using EagleView Assess to detect five times more anomalies than the human eye and provide irrefutable evidence of damage to insurance companies. Read on to learn more about their experience and how Assess paves a faster path to claims resolutions.

Why Do Insurance Carriers Deny Roof Repair Claims?

Aside from simply failing to detect certain impact marks with their eyes, insurance carriers deny roof claims for a number of reasons, including:

- They determine damage existed prior to the storm and is not relevant to storm-related coverage.

- There is insufficient documentation to support the claim.

- The homeowner failed to prevent further damage after the storm.

- They determine damage is a result of incorrect installation or faulty materials.

Roofing contractors can make their own assessments, issue their own reports, and provide their own documentation to try to get a claim approved, but in the end, it’s your word against the insurance company’s if you’re both conducting manual inspections. When damage detection comes down to human eye versus human eye, there’s not much to do — aside from getting a second opinion — after an insurance company denies a claim. Lisa Cimaroli, owner of Cornerstone Restoration and JM Home Repair in Florida, found this out when her own claim was denied after Hurricane Nicole did significant damage to her house.

However, using EagleView Assess put the odds in her favor. AI-powered damage detection software from EagleView Assess enables roofers to paint an undeniable picture of damage and remove the bias from the assessment process.

AI-powered Damage Detection = Irrefutable Accuracy

Cimaroli had opted to have her roof inspected using an EagleView Assess drone prior to the storm. After the storm, her own project manager conducted a roof inspection and reported 50 impact marks — enough to warrant an insurance claim that was subsequently denied. Turning again to EagleView Assess, the drone detected 240 impact marks.

“When the report came back, you could see where the drone had actually assessed each area of the roof slope,” said Cimaroli. “You could see the direct path that the storm took, how the debris was flying, and where the roof was affected very specifically. A lot of things that the human eye missed, AI detected.”

The insurance company had no choice but to capitulate and pay for the entire roof.

Expediting the Claims Process With EagleView Assess

With AI-powered damage detection, it’s no longer your word against theirs. EagleView Assess gives roofers an easy way to validate insurance claims by removing subjectivity from the equation. The solution allows contractors to complete roof inspections quickly — from the safety of the ground — with easy-to-fly drones that offer AI-driven obstacle avoidance software and a 360° view camera system. Assess consistently and accurately identifies hail, wind, and other types of damage with very little learning curve for operators. Cimaroli said, "I am not technologically savvy, but once you get it set up, it's as easy as drawing a box around the structure you want to utilize and pushing a button. It does most of the work for you."

EagleView Assess also allows roofers to combine high-quality images of roofs to create digital roof reproductions and to automatically generate professional reports that include objective, detailed evidence to support claim validation. Upon sending the Assess report to her insurance provider, "it was pretty much a no brainer at that point," Cimaroli said. She had previously sent all the supporting evidence they would need to approve the claim — to no avail. The provider approved the roof replacement "in direct correlation to the drone report. It wasn't until they couldn't argue with the drone report," that they agreed to pay.

With accurate imagery and reporting, roofers can present indisputable damage data to insurance companies, better inform repair estimates and claims decisions, and ultimately win more repair work — more often.

Take the Guesswork out of Damage Detection

Roofing contractors can leverage drone technology like EagleView Assess to not only validate roof repair claims, but to do it faster while building a happier customer base. Skipping the wait for a manual inspection gives you the competitive advantage of speed, especially in post-storm regions. And the more you help your customers expedite their claims approvals, the better your business reputation.

Discover how AI-powered EagleView Assess can help you grow your roofing business by getting in touch with our roofing experts today.